Jjill Credit Card Login: Managing Your J.Jill Credit Card Account Online

Before managing your credit card account, you need to understand the Jjill credit card login steps and follow up with the following guide. Here is how to log in:

The J.Jill Credit Card is intended for loyal customers of J.Jill, a retailer in comfortable and stylish women’s wear.

This credit card has rewards and special discounts, amongst other related privileges, especially for those customers who make purchases from J.J.’s stores or online.

How to Manage Your Jjill Credit Card Login Online

For you to effectively manage your Jjill credit card, you need to follow the following payment scheme online:

1. Visit the J Jill Credit Card Payment—Login Page

Go to the Jill Credit Card login page, which will redirect you to the official website of J. Jill Credit Card, and sign in using your username and password.

For instance, if you are a beginner and you want to access the website, you will be required to sign up for an account where you will be required to enter your card details as well as personal information.

2. Go to the Payments Section

Upon signing in, usually at the initial monitor of the website, there is a tab that says “Payments” or “Make a Payment”.

This section here contains the balance details, the due date, and how payment can be made.

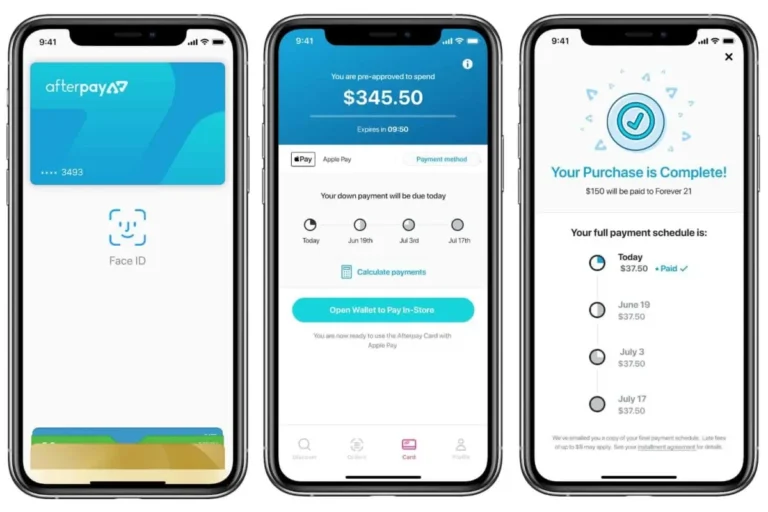

3. Choose Your Payment Method

Choose, for example, a linked bank account to complete your payment.

If you have not completed the setup of the payment method, you can do it by providing details of your bank account.

This will be kept for later use when necessary payments have to be made.

4. Select the Payment Amount

It is also possible to pay the whole amount, the minimum amount, or any amount between the two.

Sadly, this offer does not include any interest charges, but in case you need more information on your finances, refresh the page and choose the amount that does not attract interest charges.

5. Confirm Your Payment / Payment Time

After choosing the amount you want to pay and the method of payment, you have to check your payment information.

Depending on the amount and the time convenience,, the payment can be made at a later date, or it can be made instantly.

Click the green or orange “Submit” button to finalize the transaction and receive a confirmation for your records.

READ ALSO:

How to Use the Jjill Credit Card Login

Using your J.Jill Credit Card is straightforward. Once you have been approved and receive your card, you may charge your purchases in any J.Jill store or online at the J.Jill website.

To manage your J.Jill Credit Card account online, you can log in on the website of Comenity Bank, which issues the card.

1. Log In Online: The J.Jill Credit Card login page is hosted on the Comenity Bank website; log in there with your username and password.

2. Account Overview: After logging in, one would see the current balance, the amount of credit available, and recent transactions.

That will give an idea of where your spending stands with the budget.

3. Make Payments: You can directly make payments through the online portal. To avoid interest charges and to keep your account in good condition, pay off your balance in its entirety each month.

4. Track Rewards: The online account also shows how many rewards points you’ve earned. When you have acquired enough points, you can use those for discounts on your J.Jill purchases.

5. Update Account Information: Whether your address has changed or you need to update some other aspect of your personal information, you can do so through the online account.

Benefits of the J.Jill Credit Card

By using the J.Jill credit card, some offers are bound to come in, such as:

1. Rewards Program

Arguably the most appealing aspect of the J.Jill Credit Card is its rewards program.

You earn points on every dollar you spend at J.Jill, redeemable for rewards that include discounts on future purchases.

2. Special Discounts

As a cardholder, you will most likely get special discounts and promotions, such as a birthday discount and special offers throughout the year.

If you shop at J.Jill with some regularity, these discounts can add up quite nicely.

3. No Annual Fee

There is no annual fee for the J.Jill Credit Card. You will be able to enjoy the benefits of the card itself without paying just to have it.

4. Cardholder Events

J.Jill conducts special events for cardholders where extra savings are available along with other perks. These events are a nice perk for loyal shoppers.

Cons of the J.Jill Credit Card

Sadly, there are mishaps that could possibly occur when using this card, like:

1. High-Interest Rate

Like many store credit cards, the J.Jill Credit Card contains a high interest rate.

If you carry a balance from month to month, you’ll be charged significant interest, which could quickly offset any rewards you have earned.

2. Limited Use

The J.Jill Credit Card is only used at J.Jill stores or on the J.Jill website. This surely limits its applicability compared with other credit cards that can virtually be used anywhere.

3. Rewards Restrictions

The rewards that you earn are only redeemable when making a purchase at J.Jill, so if you’re looking for rewards that offer a little more flexibility, this may not be the best card for you.

4. Overspending

It has some reward programs and special discounts that may lure you into spending more than you wanted to.

This calls for sticking to a budget as well as avoiding unnecessary overspending for earning rewards.

READ ALSO:

Who Is the Best User for This Card?

The J.Jill Credit Card is best suited for:

1. Frequent J.Jill Shoppers: If you shop regularly at J.Jill, then this card can definitely help you earn rewards and save money with your purchases.

2. Budgeters: The fact that cardholders have exclusive discounts and promotions really helps one to budget even more reasonably than when one is already a lover of the clothes at J.Jill.

3. Those Wanting to Build Credit: If one looks to build or improve their credit score, the J.Jill Credit Card is not bad, provided one makes use of it responsibly and pays one’s balance in full each month.

4. Those Who Do Not Carry a Balance: With the high interest rate, it’s advisable to have this card if one can pay the balance in full each month.

If you carry a balance, the interest charges could quickly outweigh any rewards you have earned.

Our Verdict

Many loyal shoppers at J.Jill find that the rewards to be enjoyed, including special discounts, make J.Jill Credit Card the best option.

The card offers a no-frills rewards program, special promotions, and no annual fee; hence, it is appealing for those who shop often at J.Jill.

The tricky thing, though, is to use the card wisely. Without a particularly low interest rate, carrying a balance can get very expensive, so it’s critical that you pay off your balance in full each month.

Secondly, since all rewards can only be utilized at J.Jill, this card is best suited for those who already regularly shop there.

If you consistently spend money with J.Jill and can be responsible when it comes to spending, the J.Jill Credit Card is a phenomenal way to save some cash on clothes you love.

Just keep an eye on how much you are spending, pay the balance on time, and don’t let any rewards or discounts that you get as a cardholder slip between the cracks.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.