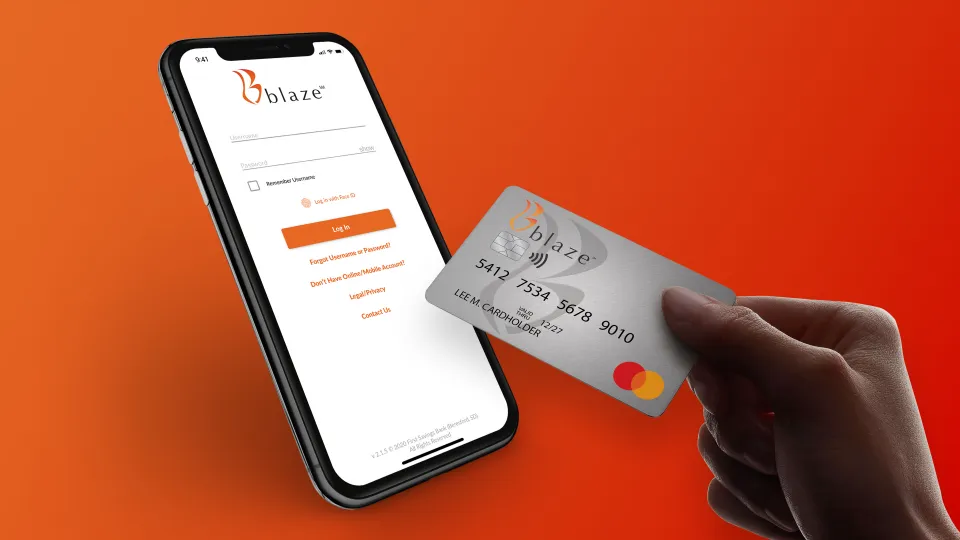

Blaze Credit Card Login: How to Login and Security Features

The Blaze credit card login shouldn’t be a problem following it simple one-step credential submit mode. Most returning users enjoy this easy process. If you aren’t familiar with the steps, follow up to get a quick guide.

The Blaze Credit Card is widely used by those looking for an upgrade or a reestablishment of their credit history.

Of primary convenience for credit management it provides an easy-to-use web interface offered to the Blaze Credit Card Services holders only.

Discussing about the login steps for the card, ways on how to change your pin, similar credit cards with close functions as the Blaze credit card, and more.

Blaze Credit Card Login Steps

Blaze Credit Card Login is useful if you want to be able to pay your card, view its activity and operations. This is how to log in to your account: This is how to log in to your account:

1. Official Website: You can start by opening the official Blaze Credit Card login page. This is often obtained from the Blaze Credit Card Services website.

2. Login: You will get a window where you will be asked to enter your username and password for identification.

These are the same you had when you created your online account for your company.

3. Verify (if required): Sometimes more actions might be necessary for authentication based on security settings such as entering a set of security questions or entering a code.

The code usually named OTP will be received by email or a phone.

4. Log In to Your Online Account: Math/login-in will allow you to check the balance of your account, transactions, the due date for the payment, as well as many others.

It is easy to use, which makes it possible for one to go through all the offered options.

READ ALSO:

How to Reset Your Blaze Credit Card PIN

Blaze Credit Card PIN can also be easily changed in case you may have forgotten it or for security purposes. Here’s how you can reset your PIN:

1. Log In to Your Account: Last but not least, to access their Blaze Credit Card account, you have to log in to their website.

2. Account Settings: Go to the sign-in page and click “Account Settings” or “Security.” This is where you will change the PIN.

3. Reset PIN: You have can choose to reset it or change it. It could be through questions about a secured data or through the use of the email or the SMS code.

4. New PIN: Type a new PIN, you wish to have to replace the existing one with.

This will, of course, be something which I will or can guess easily but would be rather difficult for other people to guess.

5. Confirm the Change: When entering the new PIN you will change it to the new PIN and confirm the change. A new PIN is generated automatically, effective this action;

It is advisable to set a more secure form of number such as the PIN, but it should be chosen in such a way that can easily be remembered because frequent changing of the PIN is disruptive.

Security Features of Blaze Credit Card

The Blaze Credit Card has put some security features into its design to protect an account and personal information:

1. Fraud Protection: Blaze Credit Card Services keeps track of your account to ensure no strange activities are recorded and you will be on notified in such a situation.

2. Encryption: The online portal uses the most secure encoding to the individual account option and while engaging in any financial exercise for the protection of your data.

3. Account Alerts: For notifications, you can use both the email alerts and the SMS alerts that will enable it notify you of activities within the account such as payments dates and bulky transactions.

4. Zero Liability Protection: If your card becomes fraudulent Blaze Credit Card Services will ensure that you have zero liability meaning you will not be held responsible for charges you did not incur.

Customer Service and Support

Blaze Credit Card has in-house professional customer service to assist their cardholders in times of trouble.

You can reach them by calling or emailing, or you can use the secure message option available in the online portal.

They will be there to help you out with all issues that relate to technical faults during login or concern management of your account and beyond.

READ ALSO:

- Gold Royal Trust Credit Card: How to Apply Easily

-

J Jill Credit Card: Payment Methods, Features and Alternatives

Similar Credit Cards Options

The Blaze Credit Card is an excellent option for anyone who wants to build or rebuild their credit.

However, depending on different types of needs, there is a wide range of many other options available. For instance:

1. Discover it Secured Credit Card

Discover It Secured credit card is perfect for building credit and making cash back off of purchases made. It does need a refundable security deposit and reports to all three major credit bureaus.

2. Capital One Platinum Credit Card

It is an unsecured credit card, doesn’t require any deposit, focuses on fair-credit borrowers, and offers access to a higher credit line after the first five on-time monthly payments.

3. Credit One Bank Unsecured Visa for Rebuilding Credit

This Credit One card has cashback rewards and is available to those with less-than-perfect credit, making it a good alternative for those who want rewards while rebuilding their credit.

4. OpenSky Secured Visa Credit Card

OpenSky Secured Visa Credit Card does not require any credit check; hence, almost everyone gets approved.

This is a no-frills card that will help you in building up your credit without going through the hassle of a traditional credit check.

5. Petal 2 “No Fee” Visa Credit Card

This no-fee card is specifically aimed at individuals with thin or no credit at all.

No security deposit is needed, and the cardholder gets cash back on all of their spending, making this an even better entry-level card for those in the world of first-timers.

Final Thoughts

The Blaze Credit Card is a great tool for those who handle their credit effectively, especially when they are in the process of building or rebuilding credit history.

Being able to log in easily and reset your PIN or even manage your account online adds to the convenience.

While there is much to be liked about this card, other credit cards may further broaden that selection and offer you something more suited for your needs.

With Blaze or any other card option, the key elements to financial health are being aware of features, benefits, and processes involved with your credit card.

Leave your thoughts about this post in the comments section, and don’t forget to share it with the people you care about if you find it valuable.